As a startup or business owner, grasping the concept of tax deductions is crucial for optimizing your financial health. Tax deductions allow you to reduce your taxable income by subtracting certain business-related expenses from your total revenue. This means that the more you can deduct, the less you will owe in taxes.

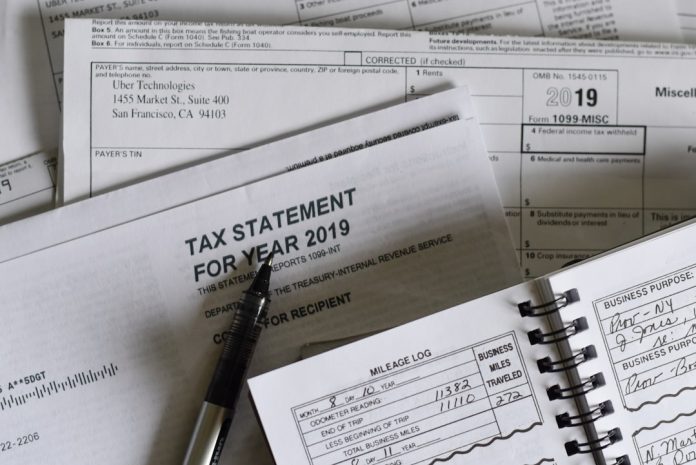

Common deductible expenses include costs related to office supplies, utilities, rent, and even salaries paid to employees. It’s essential to keep meticulous records of all your expenses throughout the year, as this will not only help you identify what you can deduct but also provide necessary documentation in case of an audit. Familiarizing yourself with the IRS guidelines on what constitutes a deductible expense can save you significant amounts of money and help you avoid potential pitfalls.

Moreover, understanding the nuances of tax deductions can empower you to make informed financial decisions for your business. For instance, if you’re considering purchasing new equipment or software, knowing that these costs can be deducted may influence your timing and purchasing strategy. Additionally, certain expenses may qualify for special deductions, such as the home office deduction if you operate from home.

This deduction allows you to claim a portion of your home expenses—like mortgage interest, utilities, and repairs—as business expenses. By strategically planning your expenditures and leveraging available deductions, you can significantly lower your tax liability and reinvest those savings back into your business.

Key Takeaways

- Understanding tax deductions for business expenses is crucial for maximizing tax savings and reducing taxable income.

- Leveraging retirement accounts can provide tax savings for small business owners and employees, offering both short-term and long-term benefits.

- Small business owners should take advantage of tax credits available to them, such as the Small Business Health Care Tax Credit and the Work Opportunity Tax Credit.

- Utilizing Section 179 allows for immediate tax deductions on equipment and property purchases, providing significant tax benefits for businesses.

- Implementing a tax-efficient business structure, such as an S corporation or LLC, can help minimize tax liability and maximize after-tax income for business owners.

Leveraging Retirement Accounts for Tax Savings

Retirement accounts are not just a means to secure your future; they can also serve as powerful tools for tax savings in your business. By contributing to retirement plans such as a Solo 401(k) or a Simplified Employee Pension (SEP) IRA, you can reduce your taxable income while simultaneously preparing for retirement. These accounts allow you to set aside a portion of your earnings pre-tax, which means that the money you contribute is not taxed until you withdraw it in retirement.

This can lead to substantial tax savings in the present while also helping you build a nest egg for the future. In addition to reducing your taxable income, retirement accounts often come with additional benefits that can further enhance your tax strategy. For example, many retirement plans allow for employer contributions, which can be deducted as a business expense.

This not only lowers your taxable income but also provides an attractive benefit for employees, helping you retain talent and improve morale. Furthermore, if you’re self-employed, you can contribute both as an employer and an employee, maximizing your contributions and tax benefits. By taking full advantage of retirement accounts, you can create a win-win situation that bolsters both your financial security and your business’s bottom line.

Taking Advantage of Tax Credits for Small Business Owners

Tax credits are one of the most effective ways to reduce your tax liability dollar-for-dollar, making them invaluable for small business owners like yourself. Unlike deductions that only reduce taxable income, tax credits directly lower the amount of tax owed. There are various credits available specifically designed for small businesses, such as the Small Business Health Care Tax Credit, which helps offset the cost of providing health insurance to employees.

By understanding and utilizing these credits, you can significantly decrease your tax burden while also investing in your workforce. Additionally, some tax credits are aimed at encouraging specific behaviors or investments that benefit the economy or society at large. For instance, if your business invests in renewable energy or energy-efficient equipment, you may qualify for credits that reward such initiatives.

These credits not only help reduce your tax liability but also align your business with sustainable practices that can enhance your brand image and appeal to environmentally conscious consumers. Staying informed about available tax credits and their eligibility requirements is essential; it may be beneficial to consult with a tax professional who can guide you through the process and ensure that you’re maximizing every opportunity available to you.

Utilizing Section 179 for Equipment and Property Purchases

| Year | Maximum Deduction | Phase-out Threshold |

|---|---|---|

| 2021 | 1,050,000 | 2,620,000 |

| 2020 | 1,040,000 | 2,590,000 |

| 2019 | 1,020,000 | 2,550,000 |

Section 179 of the IRS tax code is a powerful provision that allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This means that instead of depreciating the cost over several years, you can write off the entire amount in one go, significantly reducing your taxable income for that year. This is particularly advantageous for startups and small businesses looking to invest in new equipment or technology without incurring a heavy tax burden.

Understanding the limits and qualifications under Section 179 is crucial; as of 2023, businesses can deduct up to $1,160,000 on qualifying purchases. Moreover, Section 179 is not limited to just tangible assets; it also applies to certain types of property improvements and software purchases. This flexibility allows you to invest in various aspects of your business while enjoying immediate tax benefits.

For instance, if you’re considering upgrading your office space or purchasing new machinery, taking advantage of Section 179 can provide significant financial relief. However, it’s important to keep track of how much you’ve claimed under this section each year to ensure compliance with IRS regulations. By strategically planning your purchases and leveraging Section 179 effectively, you can enhance your operational capabilities while minimizing your tax liabilities.

Implementing a Tax-Efficient Business Structure

The structure of your business plays a pivotal role in determining how much tax you will owe each year. Choosing between different types of business entities—such as sole proprietorships, partnerships, LLCs, or corporations—can have significant implications for your tax obligations. For instance, LLCs often provide pass-through taxation benefits, meaning that profits are taxed at the individual level rather than at the corporate level, potentially leading to lower overall taxes.

On the other hand, corporations may benefit from lower tax rates on retained earnings but face double taxation on dividends distributed to shareholders. When deciding on a business structure, consider not only current tax implications but also future growth plans and potential changes in revenue. A well-thought-out structure can provide flexibility in how profits are distributed and taxed while also protecting personal assets from business liabilities.

Consulting with a tax professional or accountant who understands the intricacies of different business structures can help you make an informed decision that aligns with both your financial goals and operational needs. By implementing a tax-efficient business structure from the outset, you set a solid foundation for sustainable growth and financial success.

Making Charitable Contributions for Tax Benefits

Charitable contributions can serve as both a way to give back to the community and a strategic move for reducing your taxable income. As a business owner, donating cash or property to qualified charitable organizations allows you to claim deductions on your taxes while supporting causes that matter to you and your brand. The IRS allows businesses to deduct contributions made to eligible charities up to 10% of their taxable income for C corporations and up to 50% for individuals and pass-through entities like LLCs and S corporations.

In addition to cash donations, consider other forms of giving that may provide even greater tax benefits. For example, donating inventory or equipment that is no longer needed can yield significant deductions based on the fair market value of those items. Furthermore, engaging in charitable activities can enhance your brand’s reputation and foster goodwill within the community—an often-overlooked benefit that can lead to increased customer loyalty and sales over time.

By integrating charitable contributions into your overall business strategy, you not only fulfill social responsibilities but also create opportunities for meaningful tax savings.

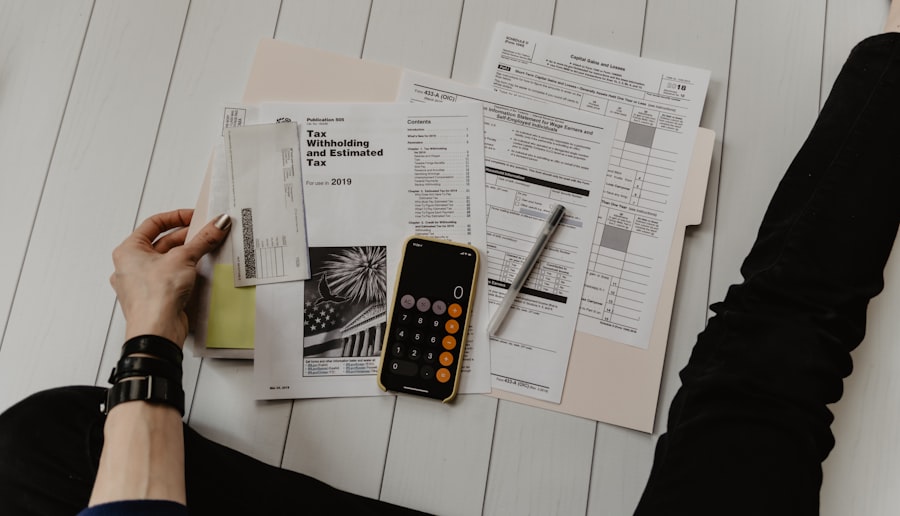

Managing Tax Withholding and Estimated Tax Payments

As a business owner, managing tax withholding and estimated payments is essential for maintaining cash flow and avoiding penalties from the IRS. Unlike traditional employees whose taxes are withheld from their paychecks automatically, self-employed individuals must take proactive steps to estimate their tax liabilities throughout the year. This typically involves calculating expected income and expenses to determine how much should be set aside for taxes each quarter.

Failing to make these estimated payments can result in hefty penalties and interest charges when it comes time to file your annual return. To effectively manage this process, consider using accounting software or hiring a professional who can help track income and expenses accurately. Regularly reviewing financial statements will give you insight into how much profit you’re generating and what portion should be allocated for taxes.

Additionally, keeping an eye on changes in tax laws or rates is crucial; adjustments may need to be made based on new legislation or shifts in your business operations. By staying organized and proactive about managing withholding and estimated payments, you can avoid surprises during tax season and maintain better control over your finances.

Working with a Tax Professional for Strategic Planning

Navigating the complexities of taxes as a startup or small business owner can be overwhelming; this is where working with a qualified tax professional becomes invaluable. A knowledgeable accountant or tax advisor can provide tailored advice based on your specific business model and financial situation, helping you identify opportunities for savings that you might overlook on your own. They can assist with everything from choosing the right business structure to maximizing deductions and credits available to you.

Moreover, a tax professional can help you develop a long-term strategic plan that aligns with both your current needs and future goals. They can guide you through year-end planning strategies that optimize your tax position while ensuring compliance with all regulations. Additionally, having an expert on hand during audits or inquiries from the IRS can provide peace of mind and protect your interests effectively.

By investing in professional guidance now, you’re not just addressing immediate concerns; you’re laying the groundwork for sustainable growth and financial success in the years ahead.

For entrepreneurs looking to optimize their tax strategies, it’s essential to stay informed about the latest tips and guidelines. A related article that can provide valuable insights into this topic is available on a comprehensive business resource website. You can read more about effective tax strategies for entrepreneurs by visiting this detailed guide. This article offers practical advice on managing your business finances better and understanding the nuances of tax planning, which can ultimately help in maximizing your returns and minimizing liabilities.

FAQs

What are tax strategies for entrepreneurs?

Tax strategies for entrepreneurs are specific plans and actions taken to minimize the amount of taxes paid by a business owner. These strategies can include taking advantage of tax deductions, credits, and other incentives provided by the government.

Why are tax strategies important for entrepreneurs?

Tax strategies are important for entrepreneurs because they can help reduce the financial burden of taxes on their business, allowing them to keep more of their profits. By implementing effective tax strategies, entrepreneurs can improve their cash flow and overall financial health.

What are some common tax strategies for entrepreneurs?

Common tax strategies for entrepreneurs include maximizing deductions for business expenses, utilizing retirement accounts to save on taxes, structuring the business in a tax-efficient manner, and taking advantage of tax credits and incentives available to small businesses.

How can entrepreneurs stay updated on tax laws and regulations?

Entrepreneurs can stay updated on tax laws and regulations by working with a qualified tax professional, attending tax seminars and workshops, subscribing to tax publications, and regularly checking the official IRS website for updates and changes in tax laws.

What are the potential risks of not implementing tax strategies for entrepreneurs?

The potential risks of not implementing tax strategies for entrepreneurs include paying more taxes than necessary, facing penalties for non-compliance with tax laws, and missing out on opportunities to maximize tax savings and benefits for the business.