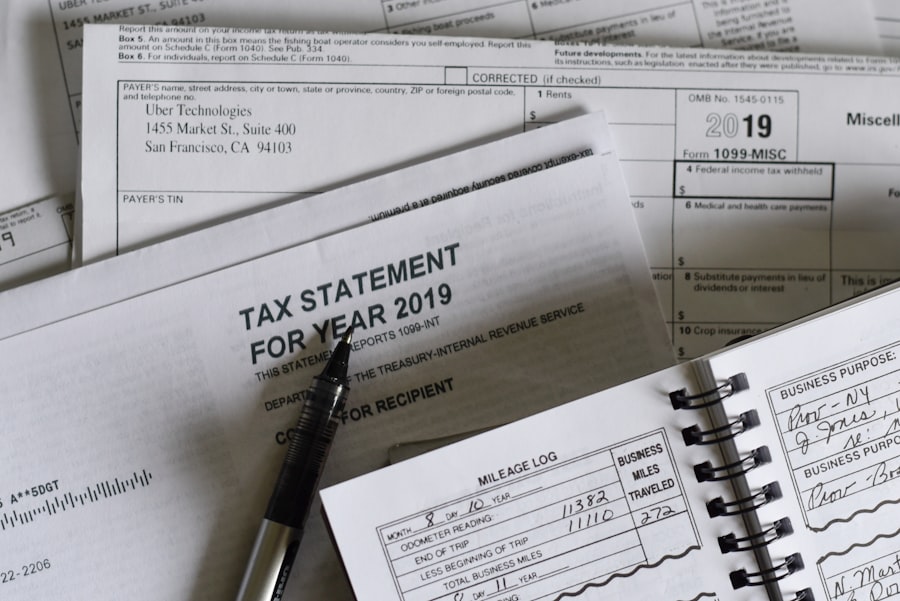

As a business owner, grasping the intricacies of your tax obligations is paramount to ensuring your enterprise thrives. You must familiarize yourself with the various types of taxes that may apply to your business, including income tax, sales tax, payroll tax, and self-employment tax. Each of these taxes has its own set of rules and regulations, which can vary significantly depending on your business structure—be it a sole proprietorship, partnership, corporation, or limited liability company (LLC).

Understanding these distinctions is crucial, as they will dictate how you report your income and expenses, as well as the deductions you may be eligible for. Additionally, you should be aware of the deadlines for filing and paying these taxes to avoid penalties and interest that can accumulate quickly. Moreover, it’s essential to recognize that tax obligations are not static; they can evolve based on changes in your business activities or shifts in tax legislation.

For instance, if you expand your operations into new states or countries, you may become subject to additional tax requirements. Similarly, if your business grows and you hire employees, you will need to navigate payroll taxes and employee benefits. Staying proactive in understanding these obligations will not only help you remain compliant but also allow you to take advantage of potential tax credits and deductions that can significantly reduce your overall tax burden.

Key Takeaways

- Understanding tax obligations is crucial for businesses to avoid penalties and ensure compliance with the law.

- Implementing effective record-keeping systems helps businesses track income, expenses, and deductions for tax purposes.

- Utilizing accounting software can improve accuracy and efficiency in managing financial records and preparing tax returns.

- Staying informed about tax law changes is essential for businesses to adapt their tax strategies and remain compliant.

- Hiring qualified tax professionals can provide expert guidance and support in navigating complex tax regulations and maximizing tax benefits.

Implementing Effective Record-Keeping Systems

Establishing a robust record-keeping system is one of the most effective strategies you can employ to manage your tax obligations efficiently. Accurate records are essential for substantiating your income and expenses during tax season, and they can also serve as a valuable resource for making informed business decisions throughout the year. You should consider implementing a systematic approach to organizing your financial documents, such as invoices, receipts, bank statements, and payroll records.

This could involve using physical filing systems or digital solutions that allow for easy retrieval and management of documents. The key is to ensure that your records are comprehensive and up-to-date, as this will save you time and stress when it comes time to file your taxes. In addition to organizing your documents, it’s important to establish a routine for maintaining your records.

This could mean setting aside time each week or month to review and update your financial information. By doing so, you’ll not only keep your records accurate but also gain insights into your business’s financial health. Regularly reviewing your income and expenses can help you identify trends, spot potential issues before they escalate, and make informed decisions about budgeting and forecasting.

Ultimately, a well-structured record-keeping system will empower you to navigate tax season with confidence and ease.

Utilizing Accounting Software for Accuracy

In today’s digital age, leveraging accounting software can significantly enhance the accuracy of your financial records and streamline your tax preparation process. These tools are designed to automate many aspects of bookkeeping, allowing you to track income and expenses in real-time while minimizing the risk of human error. By utilizing accounting software, you can categorize transactions, generate financial reports, and even reconcile bank statements with just a few clicks.

This not only saves you time but also provides you with a clearer picture of your business’s financial standing at any given moment. Moreover, many accounting software solutions come equipped with features specifically designed for tax compliance. For instance, they may offer built-in calculators for estimating tax liabilities or provide reminders for important filing deadlines.

Some platforms even allow for direct integration with tax preparation software or services, making it easier to transfer data when it’s time to file your returns. By investing in reliable accounting software, you can ensure that your financial records are accurate and up-to-date, ultimately reducing the likelihood of errors that could lead to costly penalties or audits down the line.

Staying Informed about Tax Law Changes

| Year | Number of Tax Law Changes | Number of Tax Law Seminars Attended | Number of Tax Law Articles Read |

|---|---|---|---|

| 2020 | 15 | 3 | 10 |

| 2021 | 20 | 5 | 15 |

| 2022 | 25 | 7 | 20 |

Tax laws are constantly evolving, and as a business owner, it’s crucial that you stay informed about any changes that may impact your tax obligations. This means keeping an eye on both federal and state regulations, as well as any local ordinances that could affect your business operations. Subscribing to newsletters from reputable accounting firms or following industry-specific publications can be an excellent way to stay updated on relevant tax law changes.

Additionally, attending workshops or webinars focused on tax issues can provide valuable insights into how these changes may affect your business. Being proactive about staying informed not only helps you remain compliant but also allows you to take advantage of new opportunities that may arise from changes in tax legislation. For example, if new deductions or credits are introduced, understanding how they apply to your business could result in significant savings.

Conversely, being unaware of new regulations could lead to unintentional non-compliance and potential penalties. By dedicating time to educate yourself on tax law changes, you position yourself to make informed decisions that benefit your business in the long run.

Hiring Qualified Tax Professionals

While managing your own taxes may seem feasible at first glance, hiring qualified tax professionals can provide invaluable expertise that ultimately saves you time and money. Tax professionals possess specialized knowledge of the ever-changing tax landscape and can help ensure that you are compliant with all applicable laws while maximizing deductions and credits available to your business. When selecting a tax professional, look for someone with experience in your industry who understands the unique challenges and opportunities that come with it.

This tailored approach can lead to more effective tax strategies that align with your specific business goals. Additionally, a qualified tax professional can serve as a trusted advisor throughout the year—not just during tax season. They can help you navigate complex financial decisions, such as structuring your business for optimal tax efficiency or planning for future growth.

By establishing a relationship with a knowledgeable tax advisor, you gain access to ongoing support and guidance that can help you make informed decisions about your business’s financial future. Ultimately, investing in professional expertise can pay dividends in terms of reduced stress and improved financial outcomes.

Conducting Regular Internal Audits

Conducting regular internal audits is an essential practice for maintaining financial integrity within your business. These audits allow you to assess the accuracy of your financial records and ensure compliance with applicable tax laws. By systematically reviewing your financial statements, transaction records, and internal controls, you can identify discrepancies or areas where improvements are needed before they escalate into larger issues.

Regular audits not only help safeguard against potential fraud but also provide an opportunity for continuous improvement in your financial processes. Moreover, internal audits can serve as a valuable learning tool for you and your team. They encourage a culture of accountability and transparency within your organization while fostering an environment where employees feel empowered to raise concerns or suggest improvements.

By involving key team members in the audit process, you can gain diverse perspectives on how to enhance operational efficiency and reduce risks associated with financial mismanagement. Ultimately, regular internal audits contribute to a stronger foundation for your business’s financial health and compliance efforts.

Making Timely and Accurate Tax Payments

Timeliness is critical when it comes to making tax payments; failing to meet deadlines can result in penalties and interest that add unnecessary costs to your business operations. To avoid these pitfalls, it’s essential to establish a clear schedule for when payments are due based on the specific types of taxes applicable to your business. Utilizing calendar reminders or task management tools can help ensure that you never miss a deadline again.

Additionally, consider setting aside funds regularly throughout the year specifically for tax payments so that when the time comes, you have the necessary resources readily available. Accuracy is equally important; submitting incorrect information can lead to audits or disputes with tax authorities. To ensure accuracy in your payments, double-check all calculations and verify that the information being reported aligns with your financial records.

If you’re using accounting software or working with a tax professional, take advantage of their expertise to review your submissions before they are filed. By prioritizing timely and accurate payments, you not only maintain compliance but also foster a positive relationship with tax authorities—one that can benefit you should any questions arise in the future.

Responding to Tax Audits and Inquiries

Facing a tax audit or inquiry can be daunting; however, how you respond can significantly impact the outcome of the situation. The first step is to remain calm and organized—gather all relevant documentation related to the audit request promptly. This includes financial statements, receipts, invoices, and any other records that substantiate the information reported on your tax returns.

Being prepared demonstrates professionalism and cooperation with the auditing authority while helping clarify any discrepancies that may have arisen. Additionally, consider seeking guidance from a qualified tax professional during this process. They can provide valuable insights into how best to respond to inquiries while ensuring that all communications are handled appropriately.

A knowledgeable advisor can also help negotiate on your behalf if disputes arise regarding findings from the audit. Ultimately, approaching audits with transparency and preparedness will not only facilitate a smoother resolution but also reinforce your commitment to compliance—an essential aspect of maintaining trust with both tax authorities and stakeholders alike.

For businesses looking to enhance their understanding of tax compliance, it’s crucial to access reliable resources that can guide you through the complexities of tax laws and regulations. An excellent article that delves into this topic can be found at 2xmybiz.com. This article provides insightful information and practical tips to help businesses ensure they are fully compliant with tax requirements, thereby avoiding potential legal issues and penalties. Whether you’re a small business owner or part of a larger corporation, understanding and implementing solid tax compliance strategies is essential for your business’s success and longevity.

FAQs

What is tax compliance for businesses?

Tax compliance for businesses refers to the process of ensuring that a business meets all of its tax obligations, including filing accurate tax returns, paying taxes on time, and maintaining proper records.

Why is tax compliance important for businesses?

Tax compliance is important for businesses because it helps them avoid penalties and legal consequences, maintain good relationships with tax authorities, and ensure the financial stability and reputation of the business.

What are some common tax compliance requirements for businesses?

Common tax compliance requirements for businesses include filing income tax returns, paying payroll taxes, collecting and remitting sales taxes, and keeping accurate financial records.

How can businesses ensure tax compliance?

Businesses can ensure tax compliance by staying informed about tax laws and regulations, keeping accurate financial records, seeking professional tax advice when needed, and filing and paying taxes on time.

What are the consequences of non-compliance with tax laws for businesses?

The consequences of non-compliance with tax laws for businesses can include penalties, fines, interest charges, legal action, and damage to the business’s reputation. Non-compliance can also lead to financial instability and business closure.